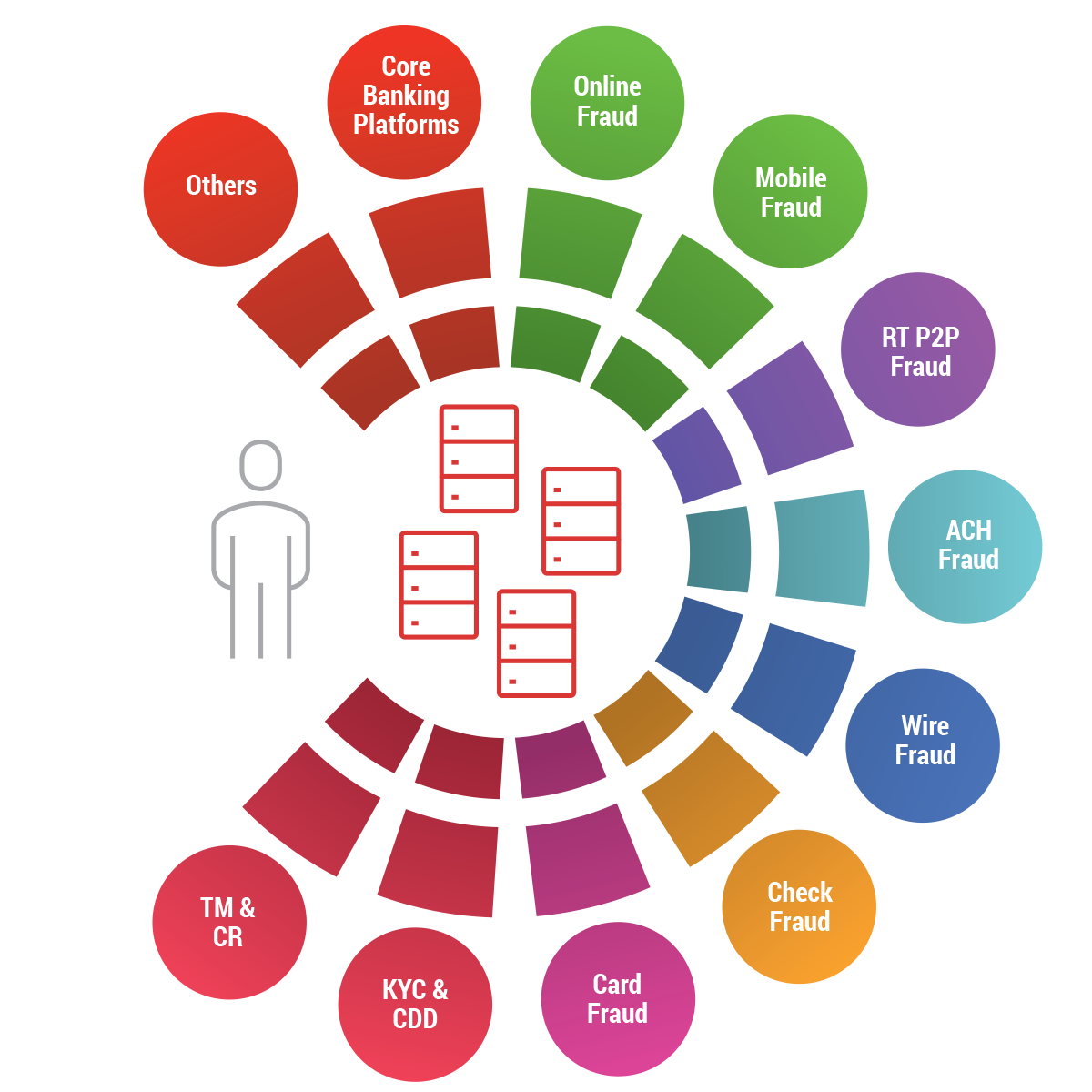

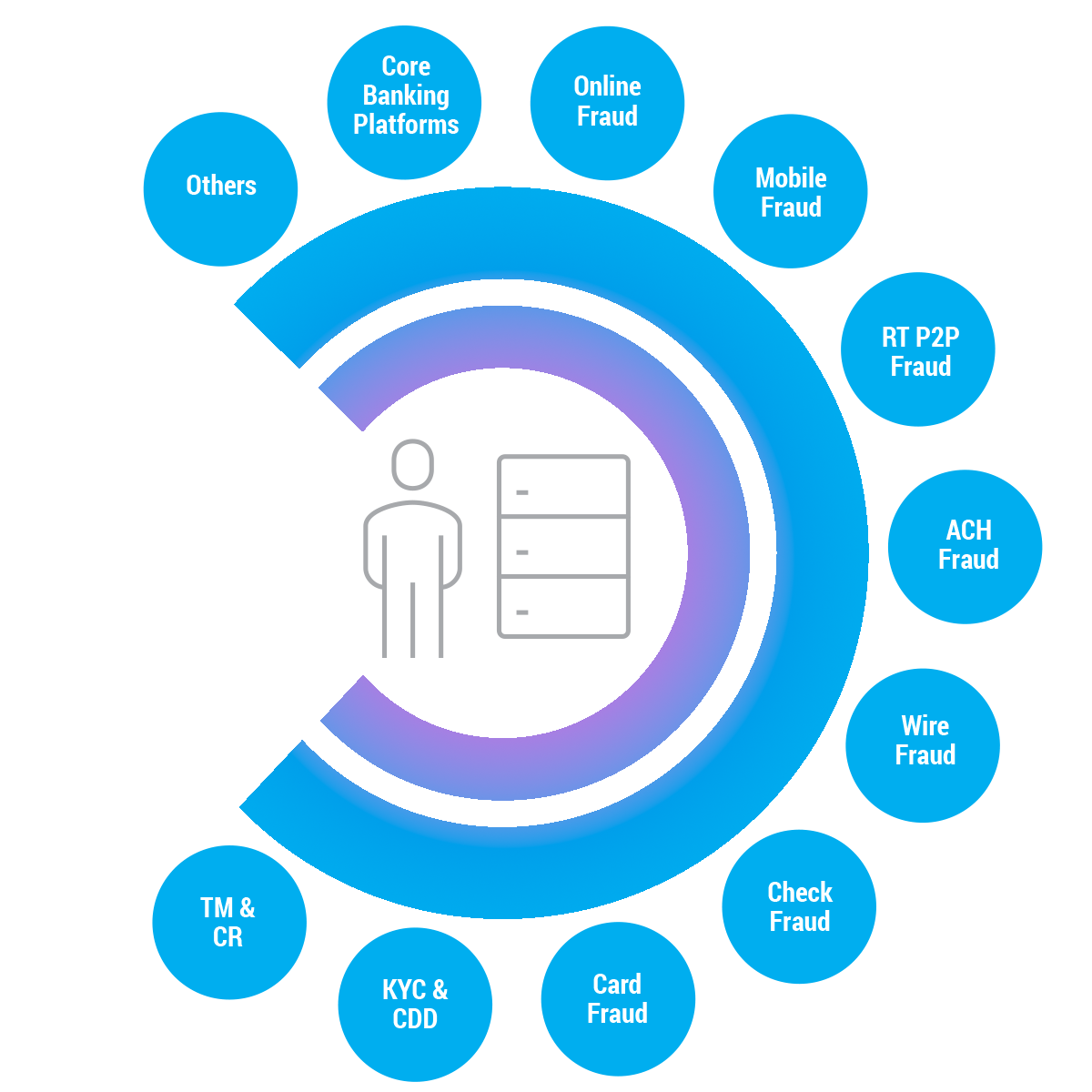

In today’s ever-changing digital landscape, fraud and money laundering trends are becoming increasingly difficult to detect. Digital channels including online and mobile, and payments channels such as P2P Zelle, RTP, Wire and ACH are at higher risk for both fraud and money laundering.

Legacy solutions can barely keep up with analysis of fraud patterns resulting in siloed solutions not smart enough to deploy an effective fincrime prevention approach. Smarter, better, faster, is our goal.

In addition, increasing regulatory demands put more pressure across cyber and financial crime detection, investigation, SAR, and CTR filings.

It’s time to work smarter, not harder.

Key Xceed360 Benefits

- Minimize your organization’s financial crime loss

- Reduce management costs

- Strengthen your fraud investigation efforts without increasing your resource costs

- Increase customer satisfaction by reducing friction caused by financial crime risk mitigation

- Apply our self-service, self-learning AI seamlessly

- Tailor made enterprise-level financial crime protection for credit unions and community banks

- Stop fraud & money laundering for $1 annual flat fee* per deposit account with Xceed360 FRAML